Vanguard had a fund that invested in precious metals and mining stocks that had performed so poorly in the past 10 years, that Vanguard decided to rename the fund and completely change its investment strategy. This shouldn’t be a complete surprise, as $10,000 invested in the fund in 2008 would be worth just $5,051 at the end of 2017. However, despite this abysmal performance, holding a small allocation to a volatile fund like this as part of an overall portfolio could actually increase the portfolio’s long-term return.

Vanguard’s founder, John Bogle, with his famous long-term vision, would likely be disappointed in the decision to change the fund’s name and strategy. How quickly we have forgotten the absolute crushing performance the fund delivered in the 10 years prior to 2008. From the beginning of 1998 to the end of 2007, the fund delivered a 15.78% compound annual growth rate. An investment of $10,000 in 1998 would have swelled to $50,096 by the end of 2007. In comparison, the same investment in the S&P 500 would have grown to just $23,475. But oh, what have you done for me lately?

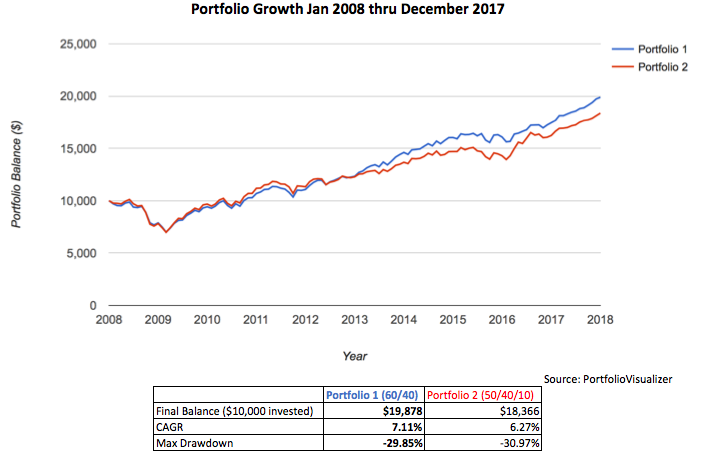

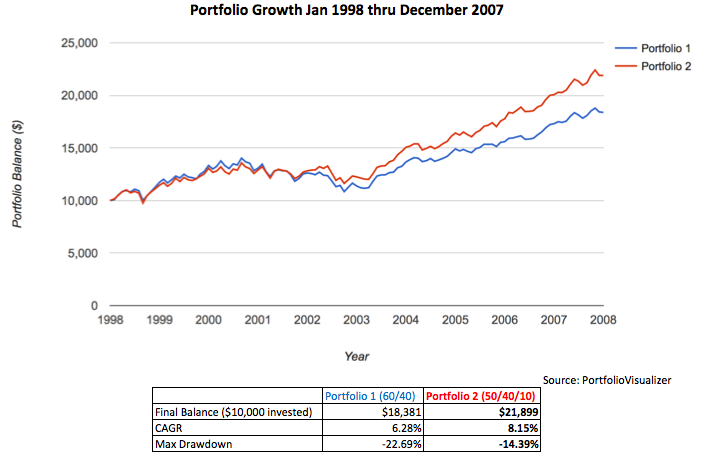

It is more useful to think of this fund in terms of its position as part of an overall portfolio. The fund is clearly risky, but research has shown that small allocations to riskier funds could increase overall portfolio performance. In this fictitious portfolio, we will assume a standard 60/40 allocation, using the US Total Stock Market Index and the Barclays US Aggregate Bond Index. We will then compare that portfolio with one where a 10% allocation to a fund that tracks precious metals and mining stocks. Both of these portfolios are rebalanced semi-annually. Rebalancing means simply adjusting the portfolio back to its original allocation if the investments grow out of sync.

First, let’s look at the period 2008 through 2017 when the precious metals and mining stocks got crushed. The 60/40 allocation outperformed, but despite the precious metals and mining stocks getting crushed, the overall results of the second portfolio aren’t catastrophic. See below:

Next, let’s look at the period 1998 through 2007 when the precious metals and mining stocks did quite well. Not surprisingly, the portfolio that included the fund outperformed the 60/40 portfolio. Also, note that the maximum drawdown is significantly less with the small allocation to the precious metals and mining stocks. See below:

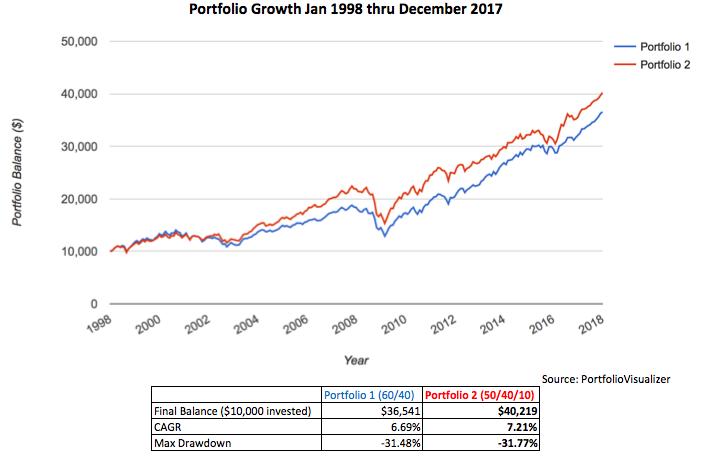

Finally, I think it is most useful to take a look at the 20-year performance of both portfolios. Even with the massive underperformance of the past 10 years, the portfolio containing a 10% allocation to precious metals and mining stocks still outperformed its counterpart. See below:

Despite the wild ride precious metals and mining stocks has taken, the results have been quite a bit smoother when incorporated as part of an overall portfolio. Additionally, its addition to a diversified portfolio actually caused the portfolio to outperform over a period of 20 years.

Its addition to a 60/40 portfolio caused it to outperform in the first 10-year period and underperform in the second 10-year period. One can’t help but wonder what would have happened in the next 10 years if Vanguard stuck with their original strategy!

Disclosures:

Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investment goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

This is a hypothetical example and is for illustrative purposes only. No specific investments were used in this example. Actual results will vary. Past performance does not guarantee future results.

Asset allocation programs do not assure a profit or protect against loss in declining markets. No program can guarantee that any objective or goal will be achieved.