I recently spoke with a builder of custom luxury homes about his experience during the 2008 recession. Despite having been in business for 40 years, he was woefully unprepared to weather the recession. His company made deep spending cuts and sold company property, but the pain spilled over into his personal assets. This builder had to liquidate all of his retirement investments and sell his personal residence to stay afloat.

The worst time to sell.

He sold at the worst possible time; his home lost close to 30% of its value and his investment accounts nearly 50%. If the builder was able to weather the recession without selling personal assets, he could have seen his home regain the majority of its previous value and his investment accounts could have recovered beyond their previous highs.

History repeating itself.

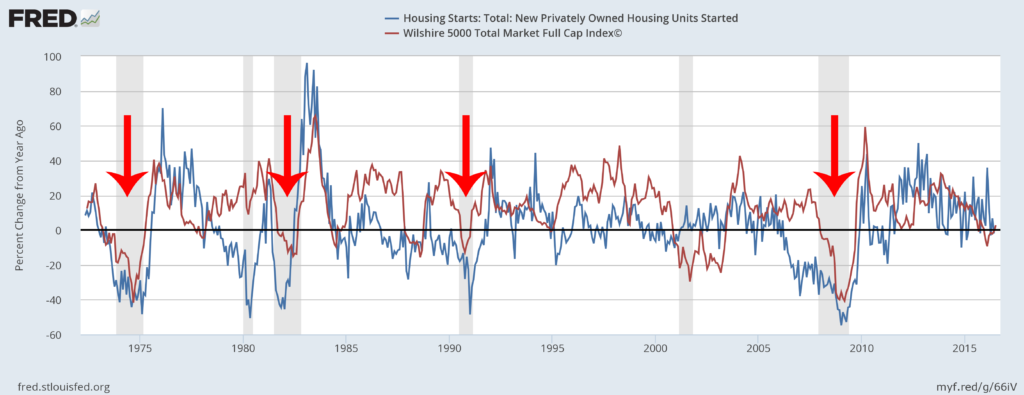

It is no secret that the construction industry experiences boom-bust cycles. A builder with 40 years of experience has likely faced several of them. The above graph depicts the percent change from the prior year in “housing starts” vs the stock market.* Not surprisingly, “housing starts” tend to plummet with the stock market during recessions (represented by gray bars). If business is slow for builders and they are forced to sell investment assets, they may have to do so at a fraction of their previous value.

What happened?

Why wasn’t the builder prepared? The problem may have been a result of improper financial planning. Even though a builder may be aware of the likelihood of a future recession, it is difficult to predict the year it will happen. In my experience, when profitability is high, builders have a tendency to allow their lifestyle to creep upwards, and when the economy turns they can no longer afford their standard of living. This is preventable with proper financial planning. It is essential for builders to establish a margin of safety with their personal finances in order to weather a recession without being forced to sell assets at deflated values.

Unfortunately for builders, traditional financial planning is designed for professionals who have steady and predictable revenue streams. Emergency funds may be established, but are often inadequate for withstanding multiple, deep recessions. Traditional financial planning focuses on a long-term goal, such as retirement, but may ignore the need for establishing a margin of safety for potentially having to endure lost revenue from multiple recessions during a builder’s career.

Work with an advisor that understands builder’s needs.

It is important for builders to work with a financial advisor that understands their unique needs. I specialize in working with builders to help them reach their lifestyle and financial goals. My grandfather, father, and I were builders in Florida and I have maintained my General Contractors license. My combined financial planning and building experience gives me a unique understanding of builders’ financial planning needs. Contact me today and we can begin formulating a financial plan for you.

*All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges or expenses. Past performance does not guarantee future results”

**The Wilshire 5000 Total Market Index™ (Wilshire 5000™) is designed to represent the total U.S. equity market. The Wilshire 5000 includes all U.S. equity securities that have readily available prices.